To make it simpler for Indian citizens, non-resident Indians, and foreign people to get this important financial document. The online application process for a PAN card in 2025 is simple and easy to complete. To pay taxes, you must have a PAN card number. To verify your tax filing information, identify you, and exclude the tax fraud, the income tax department uses a PAN number.

What is a PAN Card?

A PAN Card is a unique 10-digit number that is provided by the Income Tax Department. It assists the government with tracking financial activities and tax payments.

Why Do You Need a PAN Card?

- To Pay Taxes – If you earn money, you need a PAN to file tax returns.

- To Open a Bank Account – Most banks require a PAN to open an account.

- For Big Transactions – Buying a house, car, or making large payments needs a PAN.

- For Loans and Credit Cards – Banks ask for a PAN when giving loans or credit cards.

- As ID Proof – It is a valid identity document in India.

The PAN number looks like this: ABCDE1234F (a mix of letters and numbers).

Documents Required for PAN Card Application

To apply for a PAN Card, you must provide the following documents:

- Identity proof: Submit id proof, such as your driver’s license, passport, voter ID card, Aadhaar card, or any other official government photo ID.

- Address proof: Provide documentation confirming your residential address, such as your driver’s license, utility bills, bank account statement, passport, voter ID card, or Aadhaar card.

- Date of birth proof: Submit proof of birth, such as a birth certificate, passport, Aadhaar card, or any other official document issued by the government.

- Registration certificate If you are submitting a PAN Card application on behalf of a business, association, HUF, or firm, be sure to submit the correct registration certificate.

Apply for a PAN Card Online Via UTIITSL

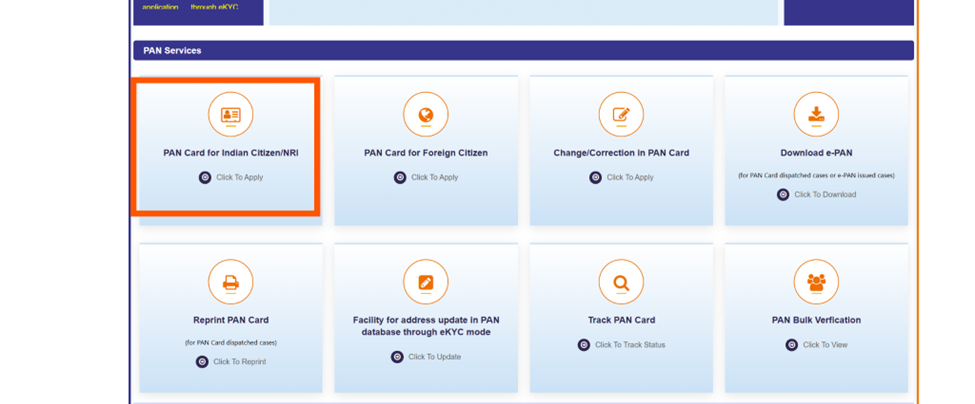

Through the UTIITSL you can apply for a PAN Card online. The income tax administration has given both of these portals permission to issue and make corrections to the PAN Card.

The steps to apply through this portal is given below:

Step 1: To apply for a PAN card online, go to the official Website of UTIITSL .

Step2: Select and click on “New PAN”.

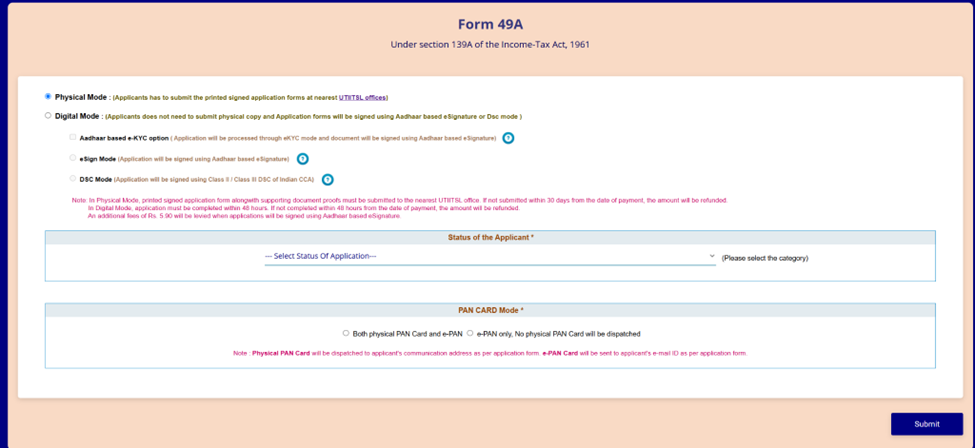

Step3: Choose Form 49A for the PAN Card. This should be for individuals who are Indians, NRI,NRE, etc.

Step4: Complete this form with the necessary details.

Step 5: After submitting the form, you would need to pay the processing fee online or by a demand draft in order to get started. Make sure to pay the application fees. An acknowledgement will be shown and emailed to your email address upon successful payment.

Step 6: once the fees and PAN Form 49A have been submitted, An acknowledgement document with the acknowledgement number will be generated.

Within 15 days, the UTIITSL will process the application with the required documentation and issue the PAN card.

Apply for a PAN Card Online Via NSDL

The steps to apply through this portal is given below:

Step1: To apply for a PAN card online, go to the official Website of NSDL .

Step2: Choose “New PAN – Indian Citizen, NRI, NRE,etc (Form 49A)”

Step 3: A token number will be sent to your email address. The “Continue with PAN Application Form” button will need to be clicked.

Step 4: Complete the form with your personal information, contact information, and AO code, then submit the necessary files.

Step 5: Once the PAN card application has been submitted, the payment page will appear . Choose your payment method and make the required payments.

How To Apply For PAN Card Offline?

Any district-level PAN agency is able to accept offline applications for PAN cards. The steps to apply through offline is given below:

Step 1: You can get a copy of the PAN card application form 49A at the NSDL or UTIITSL office or download it from their websites.

Step 2: Complete the form and provide additional information, such as identification, proof of address, and photos.

Step 3: Submit the required documents, Form and the processing fees to the NSDL/UTIITSL office.

Step 4: Within 15 working days, the PAN card is delivered to the address mentioned on the form.

Application Fees for PAN Card

The fees for applying for a PAN Card are listed below:

| Mode of submit the Application | Mode of Dispatching Card | Fees (inclusive of applicable taxes) |

| Physical Mode | Physical PAN card in India | INR 107 |

| Physical Mode | Physical PAN card outside India | INR 1,017 |

| Paperless Modes | Physical PAN card in India | INR 101 |

| Paperless Modes | Physical PAN card outside India | INR 1,011 |

| Physical Mode | An e-PAN card was sent to the applicant’s email address. | INR 72 |

| Paperless Modes | An e-PAN card was sent to the applicant’s email address. | INR 66 |

Conclusion

In India, having a PAN Card is important for performing financial activities. The PAN card is required because it is a part of the KYC regulations. Make sure you follow the detailed steps in this guide whether you choose to apply online or offline. We hope that this guide helps to explain the online and offline PAN card application process.