The Universal Account Number is a unique ID number given to every EPFO member. You only get one UAN for your whole working life, even if you change many jobs. Each job gives you a new EPF account number, but all those accounts stay linked to the same UAN. After you activate your UAN, you can quickly see your EPF balance, move your funds when you change jobs, and request withdrawals online without visiting any office.

What is a Universal Account Number (UAN)?

The UAN is a 12-digit, unique number given by the EPFO and checked by the Ministry of Labour. This number stays the same for an employee throughout their career, even if they change multiple jobs. Whenever an employee joins a new job, EPFO creates a new EPF member ID, which is linked to the same UAN. It makes it easy to transfer PF funds and request withdrawals.When you share your UAN with a new employer, your new PF account automatically gets linked to the same UAN. So all your PF accounts from different jobs stay under one number.

Why is Universal Account Number (UAN) important?

If you work in a company that deposits PF for you, you will be given a Universal Account Number (UAN). Earlier, every employer created a separate PF member ID for each job, which made it hard to track your PF money. To solve this problem, the UAN system was introduced on October 16, 2014. With this system, all your PF accounts from different jobs remain linked to a single UAN. With a single UAN, you can easily check and manage multiple PF accounts in one place. It saves time, removes confusion, and makes PF transfers and tracking easy because you only need one login instead of many.

Benefits of Universal Account Number (UAN)

The following advantages of having a UAN are:

- It keeps all your PF details in one place, making it easy to view and manage.

- It helps EPFO track your job changes smoothly.

- It reduces early PF withdrawals and helps employees save for the long term.

It gives access to many online PF services, such as:

- Checking and downloading your PF passbook

- Viewing company details, joining date, and pension (EPS) information

- Downloading your UAN card

- Updating personal details and KYC documents

- Applying for PF or pension withdrawals online

- Linking and merging multiple PF accounts from different jobs

How to generate a UAN for EPF?

When a person starts working in a company, managing PF details becomes necessary for salary records and future benefits. For someone joining a job for the first time, the employer has to create a UAN if the company has 20 or more employees.

If the employee already had a UAN from a previous job, they just need to share that number with the new employer, and it will be linked to their new PF account.

To generate a new Universal Account Number for an employee, the employer needs to:

- Log in to the EPF Employer Portal https://unifiedportal-mem.epfindia.gov.in/memberinterface/ using their username and password

- Click on “Register Individual” under the “Member” section

- Enter details like PAN, Aadhaar, and bank information

- Approve all the details in the “Approval” section

After approval, EPFO creates the UAN, and the employer links the employee’s PF account to it.

UAN Portal Services

The UAN portal gives employees different services to handle their PF accounts without any trouble.

View Services:

- Profile: See your personal details like name, UAN, date of birth, phone number, address, etc.

- Service History: See all your PF accounts from different companies under one UAN.

- UAN Card: Download and print your UAN card.

- EPF Passbook: Check your PF balance and monthly contributions.

Manage Services:

- Joint Declaration: Update personal details like name, date of birth, and gender (needs employer approval).

- Contact Details: Update mobile number and email (no employer approval needed).

- KYC: Add or update KYC details such as Aadhaar, PAN, bank account, and passport.

- E-Nomination: Add or change your nominee online.

- Mark Exit: Update the date you left the company so you can withdraw PF.

Account Services: Update or reset your EPFO password if you forget it.

Online Services:

- Claims: Apply for PF withdrawal (partial or full) after completing KYC.

- One Member, One EPF Account: Transfer or merge old PF accounts into one after updating KYC.

- Track Status: Check the status of your PF withdrawal or transfer request.

- Download Annexure K: Download Annexure K for PF transfer from exempted to non-exempted organisations.

How to Know Your Universal Account Number (UAN)?

Once the UAN is created and your PF account is linked to it, the employer usually shares the UAN and PF details with the employee. Most companies print the UAN on the salary slip. Just check your salary slip to know your UAN.

If you don’t receive it, you can also find your UAN online by following a few simple steps explained below.

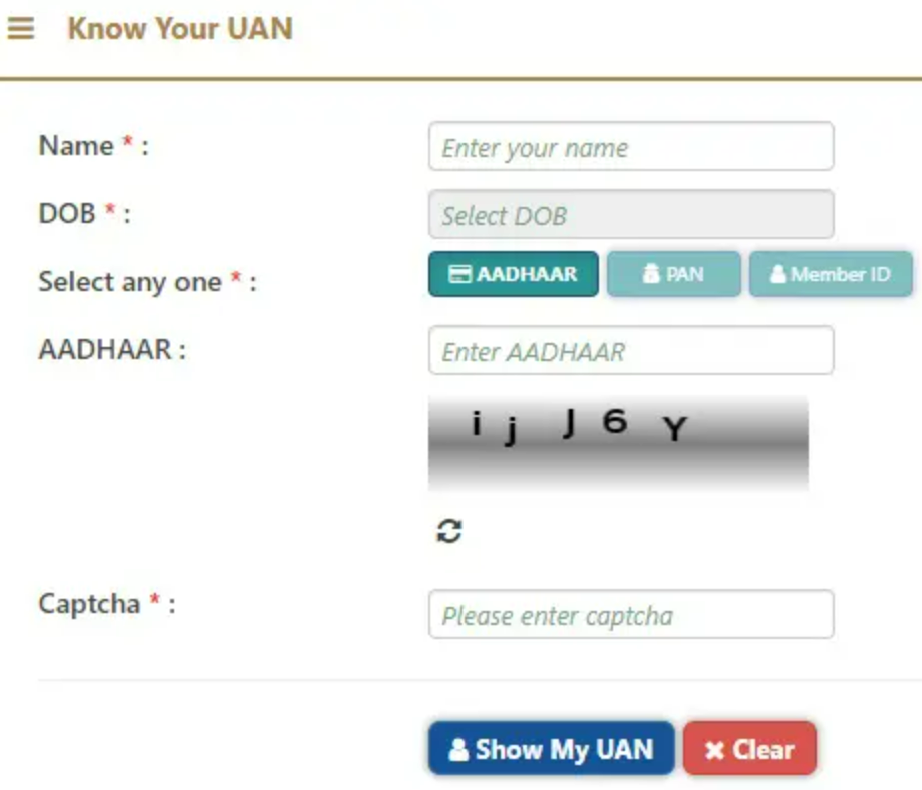

- Go to the EPFO Member Portal to check your UAN.

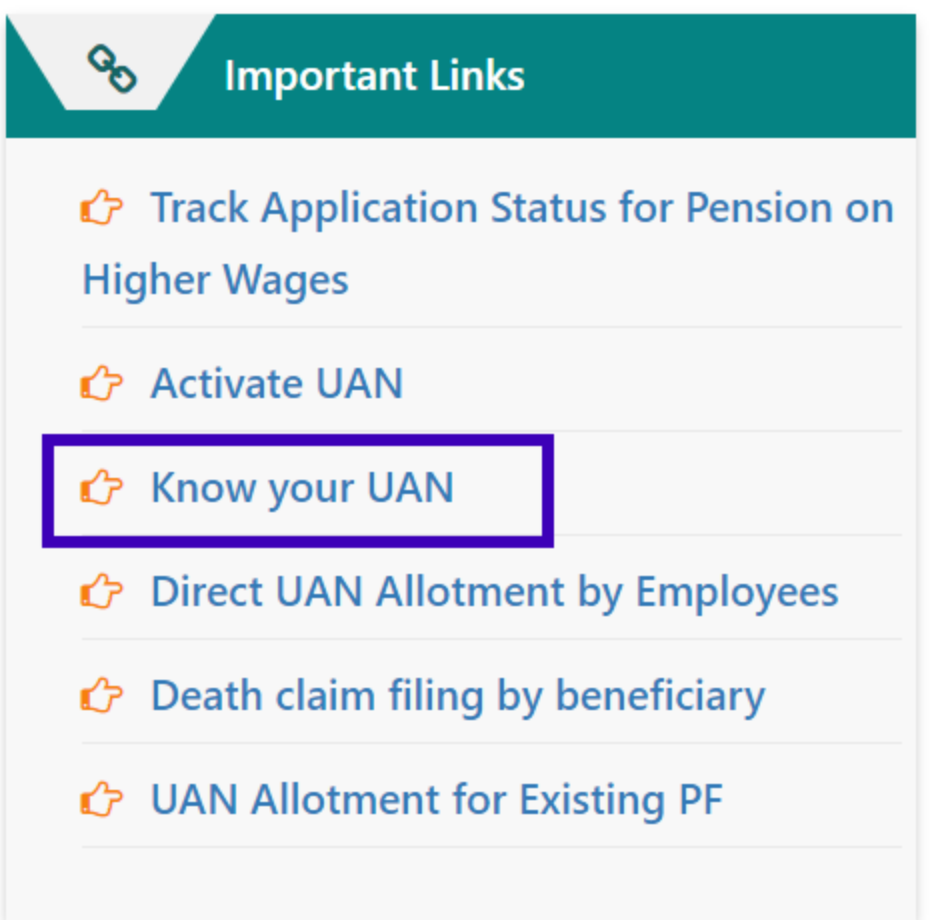

- Select the “Know Your UAN” tab, and a new page will appear.

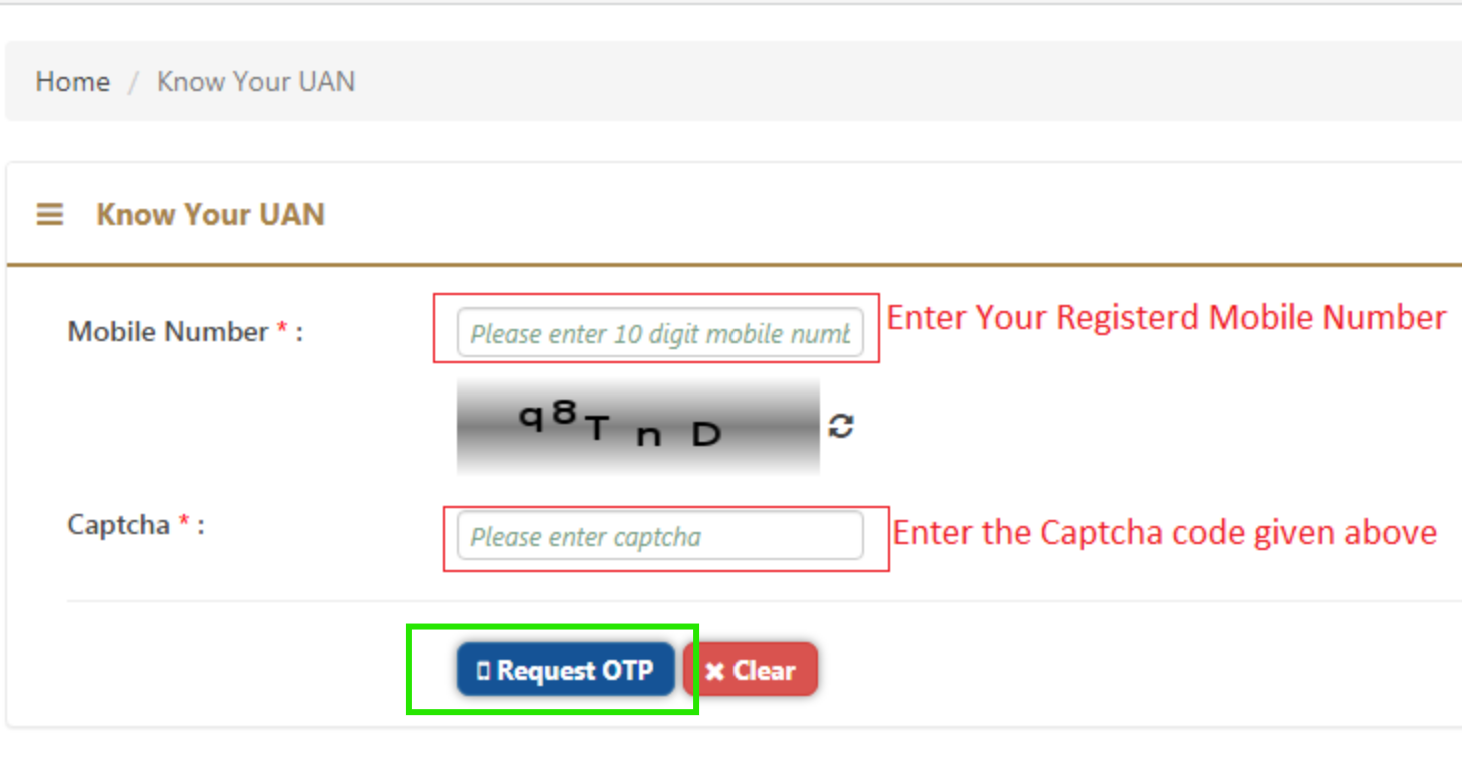

- Type your registered mobile number and the captcha code, then click on “Request OTP”.

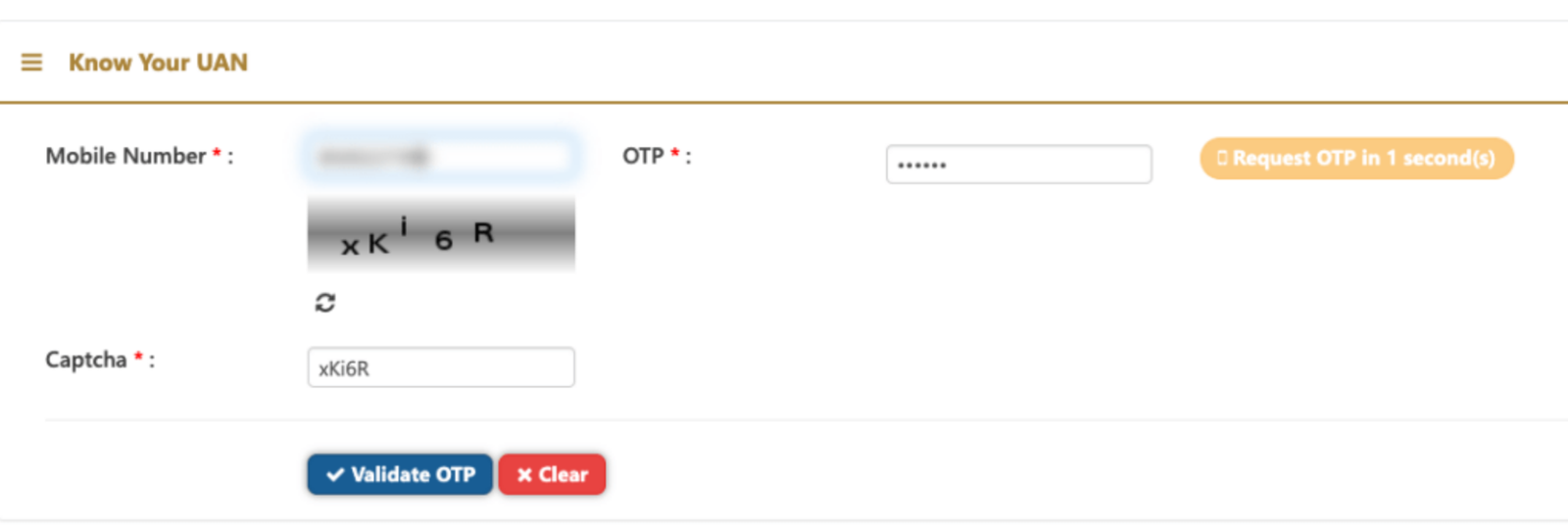

- Type the OTP sent to your phone and complete the captcha to verify.

- Next, you will need to enter your name, date of birth, PAN/Aadhaar/member ID, and complete the captcha for verification. Once all details are filled in, click on “Show My UAN”.

Required Documents for UAN Activation

To activate your UAN, a few basic documents are required. Usually, your employer collects these when you start working:

- Aadhaar Card

- PAN Card

- Bank account details with IFSC

- Any other identity or address proof, if asked

How to Activate UAN Online Through the Universal Account Number (UAN) Portal?

To use EPFO services online, you need to activate your UAN first.

If your UAN is not activated, you cannot access any online PF features. Follow these steps to activate or register your UAN online:

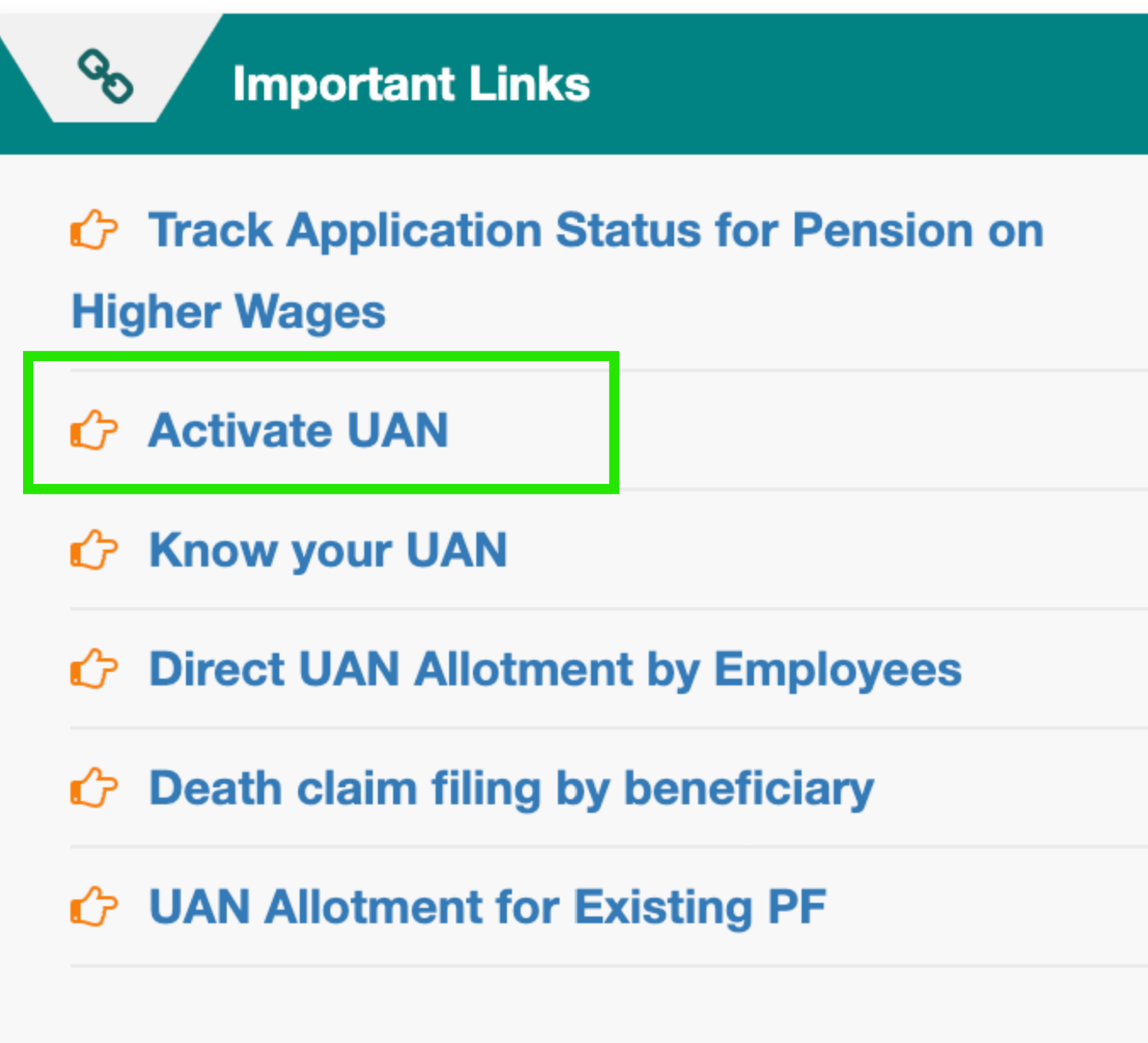

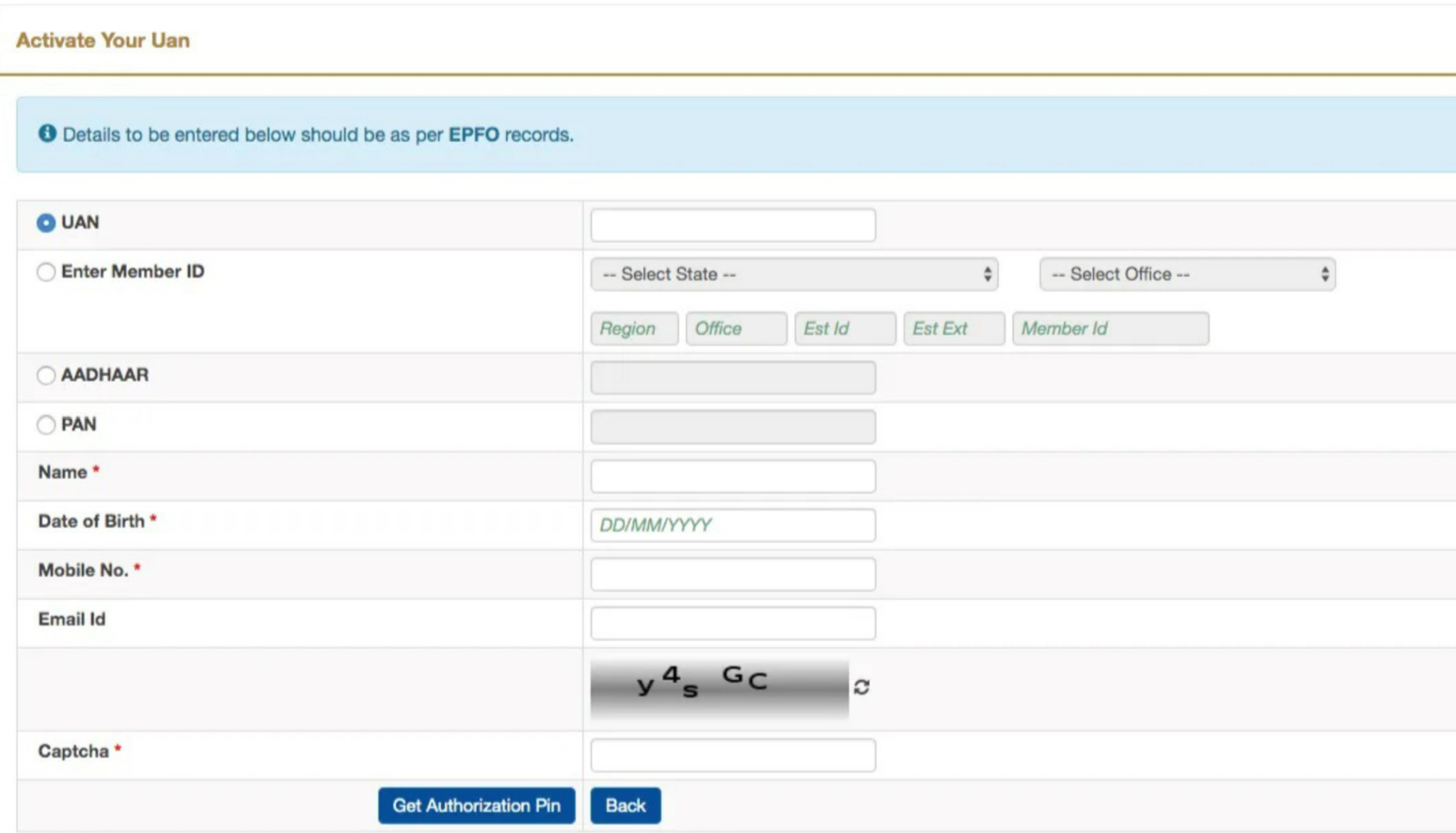

- Open the UAN portal and select Activate UAN under the Important Links section.

- Choose the UAN option/member ID, and enter other details like Aadhaar, name, DOB, and mobile number, fill the captcha, Check the consent box and click Get Authorisation Pin.

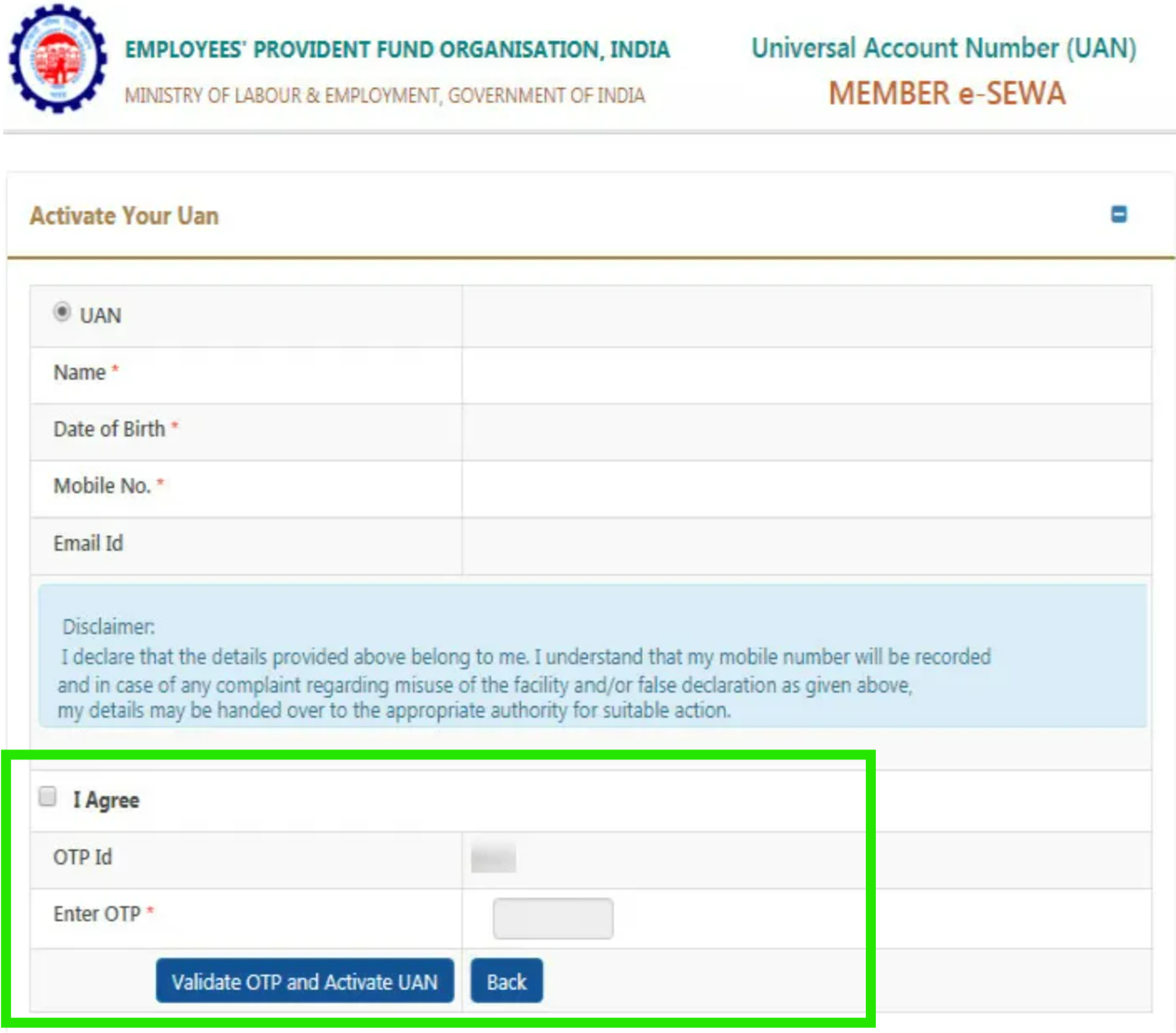

- A new page will open with your details. Check them carefully and make sure everything is correct.

- Now, click on the “I Agree” checkbox. Enter the four-digit OTP and then click on “Validate OTP and Activate UAN”.

- Once the OTP is verified, your UAN will be activated.

Once your UAN is activated, you’ll get a login password on your registered mobile number to log in to your account.

How to Link Aadhaar with UAN?

Linking Aadhaar with your EPF makes PF withdrawals and transfers smoother and quicker. And if your UAN and Aadhaar are already verified, you can complete the linking on the UAN portal yourself — no need to ask your employer for approval.

Steps to link your Aadhaar with UAN:

Step 1: Sign in to the EPFO portal using your UAN, password, and captcha.

Step 2: Go to the Manage tab on the top menu and click on KYC.

Step 3: Fill your 12-digit Aadhaar number and your name, and then save the details.

Step 4: Your request will now appear under “KYC Pending for Approval”.

Step 5: After UIDAI confirms your details, the employer’s name will show under Approved by Establishment, and your Aadhaar will show Verified by UIDAI.

How to Link Multiple EPF Accounts Under One UAN?

If you have worked with more than one employer, you may have multiple PF accounts. All these accounts should be linked to a single UAN so that checking the balance and making withdrawals becomes easier. You can link these accounts online through the EPFO portal, and often they link automatically if your Aadhaar and KYC are updated. If the online option does not work, your employer can help. Just make sure your personal details match. After linking, all PF accounts show under one UAN.

Earlier, PF had to be transferred manually using the “One Member – One EPF Account” feature. From 1 April 2024, EPFO auto-transfers PF accounts to the new employer when you switch jobs, without any form or request. All PF accounts link to one UAN.

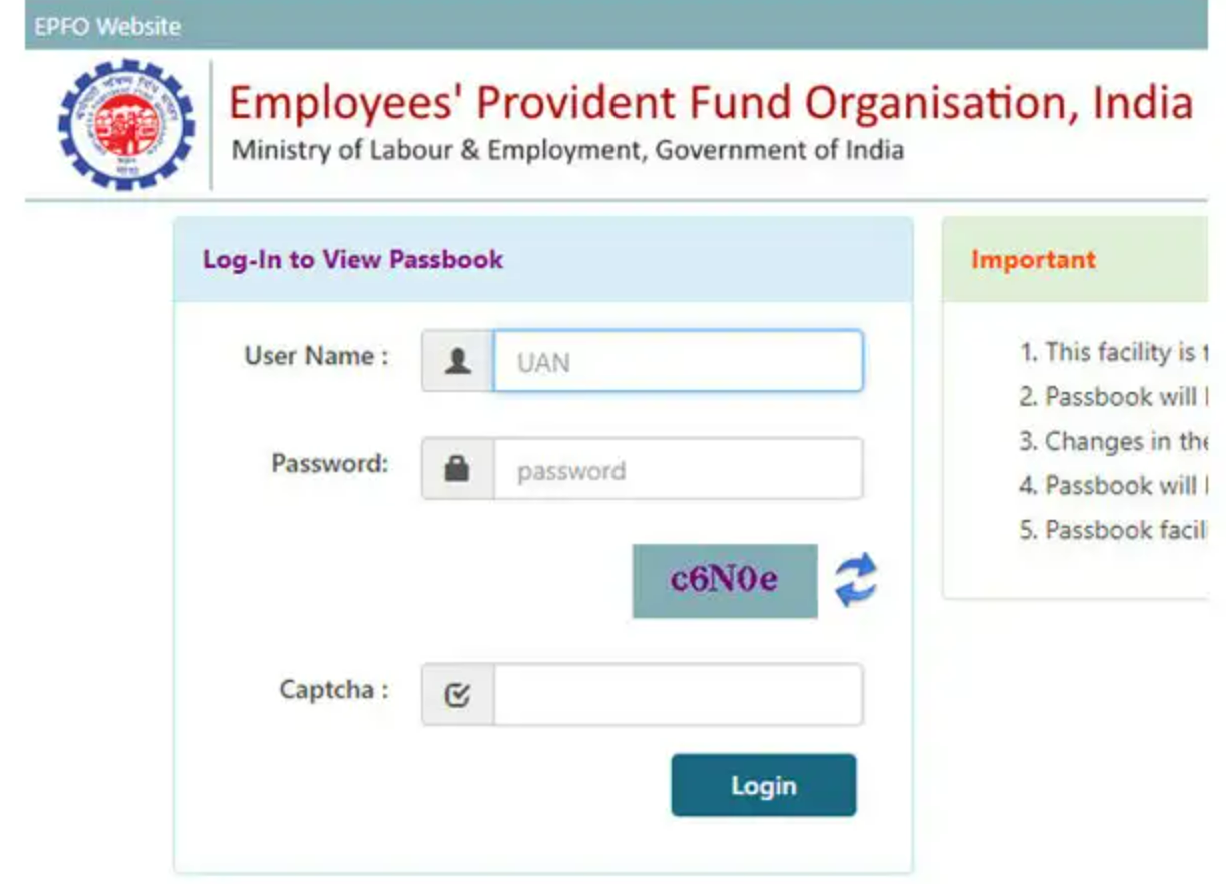

How to Download a UAN Passbook?

You can easily check and download your EPF passbook online from the EPFO portal. For this, you need to be registered on the platform. After registration, you can get your passbook in two ways:

- EPFO Portal

- UMANG App

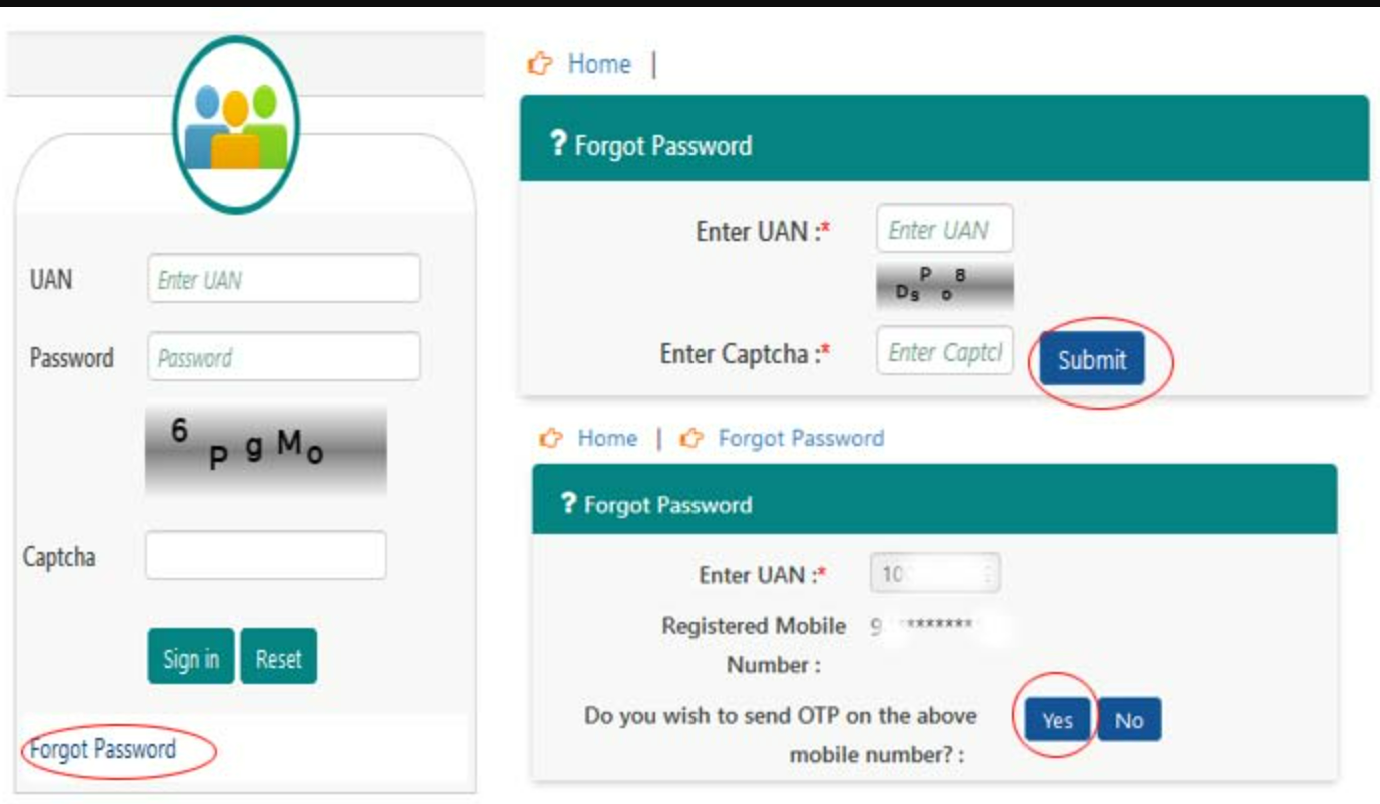

How to Reset Your UAN Password?

If you forget your UAN password, you can easily reset it online by following these steps:

Step 1: Go to the UAN portal.

Step 2: Click on ‘Forgot Password’.

Step 3: Enter your UAN and the captcha shown on the screen, then click ‘Submit’.

Step 4: Provide your name, gender, and date of birth and click ‘Verify’.

Step 5: Enter your Aadhaar number and the captcha code, then click ‘Verify’ again.

Step 6: After successful verification, enter your mobile number and click ‘Get OTP’.

Step 7: Enter the OTP received on your mobile and click ‘Verify’.

Step 8: You will be able to create a new password. Enter the new password twice in the respective fields and click ‘Submit’ to confirm.

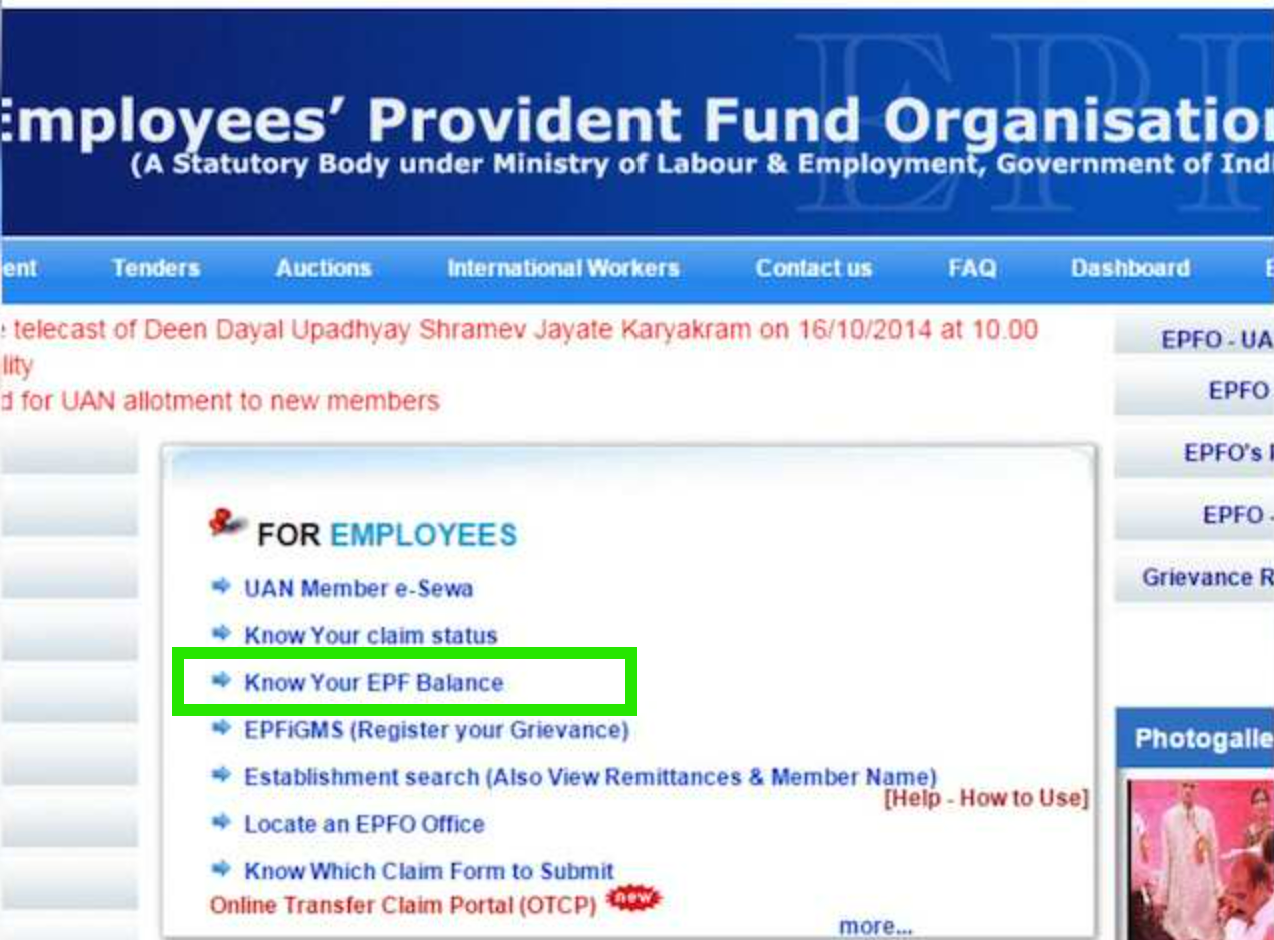

How to Check Your PF Balance With or Without UAN?

There are different ways to check your PF balance, both with UAN and without UAN.

1) If you have a UAN, you can check your PF balance through:

- The EPFO online portal

- The UMANG mobile app

2) If you do not want to use UAN, you can still find out your PF balance by:

- Sending an SMS to 7738299899 in this format: EPFOHO UAN ENG (from your registered mobile number)

- Just give a missed call to 9966044425 from your registered mobile number

How to Change/Update Personal Details in the UAN Portal?

Employees can update their personal information, such as name, dob, mobile number, and email, by logging in to the UAN portal. However, these details must match the information on the Aadhaar card, otherwise the update request will be rejected.

Updating your mobile number or email does not require employer approval. These changes are updated instantly once verified through an OTP. You can also update your bank details on the EPFO portal. But for the bank account to be linked with your UAN, your employer must digitally approve the request.

Common Issues and Solutions in UAN Registration

These are common issues during UAN activation, and how you can solve them.

- Wrong Registered Mobile Number: Sometimes the mobile number saved with EPFO is different from the one you are using. Make sure both numbers match when activating UAN.

- Wrong Aadhaar / PAN / Member ID: Enter the correct Aadhaar, PAN, or Member ID. If the details are incorrect, the registration will not work.

- Mismatch or Wrong in Personal Details: Your name, date of birth, and other details should match what is in the EPFO records and what is on your Aadhaar/PAN. Even small differences can cause errors.

Conclusion

UAN makes PF work simple. Earlier people had many PF numbers, now only one UAN is used for all jobs. With UAN, you can check PF money, transfer PF when you change job, and withdraw PF online. You don’t need to visit the office again and again. Once your UAN is activated and Aadhaar is linked, the process becomes fast and smooth. Overall, UAN gives more convenience, control, and transparency to employees.

FAQ

- What is a UAN?

It is a unique 12-digit number given by EPFO to manage your PF account.

- Do I get a new UAN for every job?

No. You get only one UAN for your whole career.

- Who gives the UAN?

EPFO generates it and the employer shares it with you.

- Can I activate UAN online?

Yes, you can activate it on the UAN portal.

- Is UAN required for checking PF balance?

Yes, for online balance check. Without UAN, you can use SMS/missed call.

- Can I link Aadhaar with UAN?

Yes, and it makes PF transfer and withdrawal faster.

- Do I need employer approval for linking Aadhaar?

Not if Aadhaar and UAN are already verified.

- Can I update my mobile number on UAN portal?

Yes, without employer approval.

- Can I update my email on UAN portal?

Yes, and it updates instantly after OTP verification.

- Can I change my bank account?

Yes, but employer approval is required for bank update.

- What if I forgot my UAN password?

You can reset it on the portal using OTP.

- Can I have multiple PF accounts?

Yes, if you worked in many companies, but all should link to one UAN.

- How do I merge PF accounts?

Use the One Member ,One EPF feature after KYC update.

- Do I need to transfer PF when changing jobs?

Since 1 April 2024, it is auto-transferred by EPFO.